Province urging residents to file their incomes taxes this year, even if they have no taxable income to report.

Tax season is around the corner, and the Ontario government is reminding you to complete your 2021 income tax return.

Residents are urged to file their taxes this year, even if they don't have taxable income to report, in order to receive credits.

Credits and benefits offered include the Seniors' Home Safety Tax Credit, which is worth 25 percent of up to $10,000 in eligible expenses to make a senior's principal residence more accessible.

Other credits the Ontario Child Care Tax Credit, which allows families to claim up to 75 percent of their eligible child care expenses, as well as a 20 percent top-up this year, and the Ontario Energy and Property Tax Credit, which provides funds to low and moderate income individuals and seniors with property taxes and sales tax on energy costs.

You're also advised to hang onto your travel receipts for local travel, in order to claim the Ontario Staycation Tax Credit next year. This allows Ontarians to claim 20 percent of their eligible 2022 accommodation expenses.

You can find out more about which credits you're eligible for by clicking here.

The deadline to file your 2021 tax return is May 2nd, 2022.

Niagara Man Charged with Child Luring

Niagara Man Charged with Child Luring

St. Catharines Trying for Development Near Hospital

St. Catharines Trying for Development Near Hospital

NRP Release Robbery Suspects Pics

NRP Release Robbery Suspects Pics

Update: Police Charge Another Man, Other Charges Dropped

Update: Police Charge Another Man, Other Charges Dropped

Speed Cameras Considered Near Schools

Speed Cameras Considered Near Schools

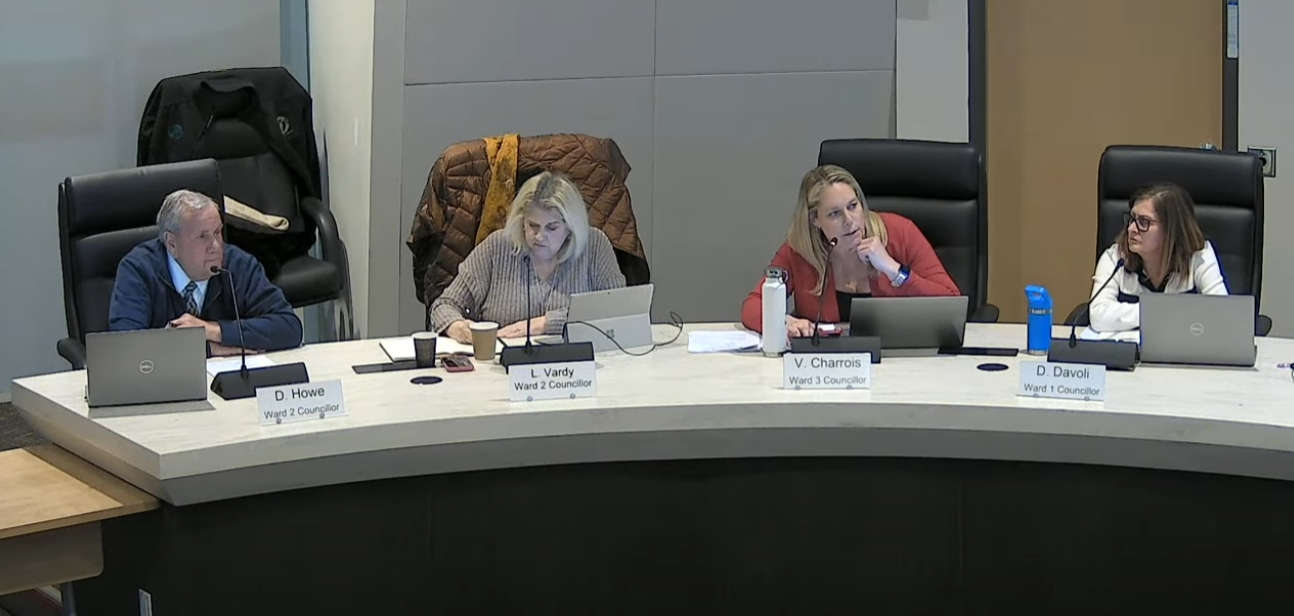

Grimsby Council Pay Reviewed

Grimsby Council Pay Reviewed

NRP Find Missing Senior

NRP Find Missing Senior

Update: Suspect Wanted for Murder

Update: Suspect Wanted for Murder